Scalping vs Day Trading: What’s the Difference?

Moreover, since everything is inside one platform, you don't have to shuffle between multiple apps. XTB Group includes but is not limited to following entities:XTB S. If you're someone who wants to save on costs for a modest portfolio and isn't a finance professional or keen on extensive share trading, AJ Bell is for you. You may even feel lost with the sheer volume of information. Payout Options: Bank Account, Paytm, UPI. Joseph Nacchio made $50 million by dumping his stock on the market while giving positive financial projections to shareholders as chief of Qwest Communications at a time when he knew of severe problems facing the company. This means profits can be magnified – as can your losses, if you're selling options. Many trade analysis tools. On the other hand, if they move towards the lower band, the market is oversold. Trendlines are significant because they can help traders and investors identify potential buy and sell signals. Create your free account or sign in to continue your search. There is no restriction on the withdrawal of the unutilised margin amount. Detailed rules regarding insider trading are complicated and generally, vary from country to country. These price points further act as major and minor support and resistance levels, future targets, insights into market sentiment, psychology based on historic price action. An options contract's expiration date is the last day that a contract is valid. There's a good reason for that. This can include setting stop loss orders to limit potential losses and sticking to your trading plan. Our comprehensive resources and intuitive platform empower you to make informed decisions and capitalize on market movements.

Suggested articles

This cost is expressed as a percentage and taken out from the amount you've invested, which lowers the amount of returns you receive. Failure to do so can lead to substantial losses. We tested 17 online trading platforms for this guide. This involves providing personal information, verifying identity, and linking a bank or brokerage account to fund trades. As with trading other markets, you can go both long and short. In case of Gross Loss. They would probably leave their long situation at an early indication of a reversal in the overarching trend so that it would be bearish by turn. To create a technical analysis strategy, you'll need to research and be comfortable using different technical indicators. Use limited data to select content. If the value of your portfolio rises, your buying power increases. Manage your portfolio with ease on iOS, Android, or your web browser. Investing typically involves a long term approach, where the goal is gradually building wealth over time. Additionally, dividend stocks, known for stable revenues and profit sharing, offer compounding returns when dividends are reinvested, enhancing position trading portfolios. Understanding these terms lays the groundwork for navigating the markets more effectively. Example: Stock X is trading for $20 per share, and a put with a strike price of $20 and expiration in four months is trading at $1. They have templates for almost every broker and if it's not there, their support team is only 1 email or message away and will work with you to include your broker on their platform. From the following Trial Balance and adjustments prepare Trading and Profit and Loss Account for the year ended 31st March, 2011 and Balance Sheet as on that date. 70% of retail client accounts lose money when trading CFDs, with this investment provider. I'm very new to the game and I want to start somewhere but there are so many to choose from and I know nothing about how reputable each may be so I have come seeking answers. There are three essential parts in quantitative trading systems. Our comprehensive resources and intuitive platform empower you to make informed decisions and capitalize on market movements. Margin can magnify profits when the stocks that you own are going up. The opposite is true for put options. Measure advertising performance. What are the advantages of using an investing app to trade stocks. Beginner traders are typically advised to use long term investing and buy and hold methods since they involve less active trading and provide more steady profits. I agree to terms and conditions. This will help you to work against the odds and beat stock market volatility.

SoFi Invest® is the best overall trading app for beginners, but these other brokers are also great for newcomers

Swing trading and day trading are similar, while long term investing is something else entirely. Trading is essentially the exchange of goods and services between two entities. Losses can mount quickly, especially if margin is used to finance purchases. » See NerdWallet's ranking of the best brokers for stock trading. The information provided in these reports remains, unless otherwise stated, the All layout, design, original artwork, concepts and other Intellectual Properties, remains the property and. And often there is little distinction in terms of the products and services that the two need. Measure content performance. "Day Trading with Short Term Price Patterns and Opening Range Breakout. A protective put is also known as a married put. As a new entrant to the world of trading, one must know the account opening process and have all documents in place, such as a PAN card, Aadhar card, income proof, and bank proof. Your email address will not be published. The broker's transparent fee structure further enhances its appeal. Futures contracts are based on https://po-broker-in.site/pocket-option-deposit-methods the same principle but are standardized. This information has been prepared by tastyfx, a trading name of tastyfx LLC. These best indicator for options trading helps traders understand the range in which the market is moving, in which direction it is going, and the duration of that move. Here, we consider a 20 day moving average trading algorithm. First session: It will start at 9:15 am and end at 10:00 am. For instance, a bullish crossover in the MACD, combined with a breakout above resistance, can be a strong signal to buy call options. Develop and improve services. It is used to identify the direction of a trend and is used as a tool to help traders and investors make informed trading decisions. Under no circumstances shall Cryptohopper accept any liability to any person or entity for a any loss or damage, in whole or in part, caused by, arising out of, or in connection with transactions involving our software or b any direct, indirect, special, consequential, or incidental damages. A hedge fund, and the popular host of Mad Money, has no mercy for such people, saying that "the people who are buying stocks because they're going up and they don't know what they do deserve to lose money. Discover the differences between our leveraged derivatives: spread bets and CFDs. Trade CFDs on one of the world's most popular platforms. Trades between foreign exchange dealers can be very large, involving hundreds of millions of dollars. It would be perfect for anyone who wants to play a unique color prediction game. Hi Andrew, was your issue solved, or do you need some help.

What is the best crypto wallet app?

Client is requested to independently evaluate and/or consult their professional advisors before arriving at any conclusion to make any investment. Monday Friday, 8:30 AM to 8 PM EST. Generally, all reputed brokers provide such services. In case of Gross Loss. Information in this article does not constitute investment advice or an offer or an invitation by or on behalf of any company within the Capital International Group of companies to buy or sell any product or security or to make a bank deposit. It offers an enhanced stock screener to help filter stocks based on criteria like sector and market cap and users can buy fractional shares for as little as $5. In terms of trading volume, it is by far the largest market in the world, followed by the credit market. Some may want to stick with the largest brokerage firms with heavy name recognition; others may be more interested in sifting through the smaller brokers to find the perfect fit for them. Our Compare Tool is fed by data gathered by our expert researchers for our forex broker reviews, so you can feel confident you have the most up to date information at your fingertips.

:max_bytes(150000):strip_icc()/Term-Definitions_Insider-trading-011fefceee344ef293501421ed12f39a.jpg)

Easy to use interface

Its education section is impressive, starting with the most basic information e. Merrill's Idea Builder uses BofA data to help brokerage clients find investments by searching across themes along social, environmental and health related lines. 👉 We provide win prediction with a high success rate. You can create a well rounded trading strategy using both styles simultaneously. Full 7th Floor, 130 West 42nd Street,New York,NY 10036. Com Trading platform. Many new options traders start with covered calls. Round Ups round up your debit and credit card purchases to the nearest dollar and invest the difference. Each brokerage platform charges different fees but, aside from commissions, investors should look at per contract fees for options, brokerage assisted trades, management or advisory fees and transfer fees when switching brokerages. California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License 60DBO 74812. Key characteristics may include volatility, volume, technical levels, earnings, and market sentiment. So really practical, I urge you to check itout—highly recommended. The following tips will help you begin your journey in stock trading. Reputable apps implement advanced security protocols, such as encryption and two factor authentication, to protect users' personal and financial information. How do we make money. Traders open and close positions within hours, minutes, or even seconds, aiming to profit from short term market inefficiencies and price fluctuations. Pay later with marginal trading option. You also have access to a Walk Forward optimizer and Cluster analysis, which are two powerful methods to test the robustness of a trading strategy.

Example to understand Intraday:

These records provide information about a company's ability to generate revenues, manage costs, and make profits. The following data may be collected and linked to your identity. All investments involve risk, including possible loss of principal. Options are essentially leveraged instruments in that they allow traders to amplify the potential upside benefit by using smaller amounts than would otherwise be required if trading the underlying asset itself. Bulkowski is a well known chartist and technical analyst and his statistical analysis set the book apart from others that simply show chart patterns and how to spot them. To make the most of these opportunities, you must understand how forex markets function and what drives them. The recipient acknowledges thatBajaj Financial Securities Limited or its holding and/or associated companies, as the case may be, are unable to exercise control or ensure or guarantee the integrity of/over the contents of the information contained in e mail /SMS transmissions and further acknowledges that any views expressed in this message are those of the individual sender and no binding nature of the message shall be implied or assumed unless the sender does so expressly with due authority of Bajaj Financial Securities Limited. It's one of the most popular swing trading indicators used to determine trend direction and reversals. There are two general factors to consider when analyzing price action. EToro's selection of 21 available crypto coins is the largest of the 26 online brokerage and trading platforms we reviewed. Between these pivotal junctures lies a peak, carving out the central spine of the W, providing traders with crucial insights. But investing fake money and, especially, losing it feels far different compared to investing your own money. Eager to learn more from you. The disadvantage is that encourages impulse investing. A rectangle chart pattern can be witnessed when the stock price movement is within a consistent price range. The following are some of the margin requirements for trading accounts. Both statements provide information about a business's income and expenses, and they are used to determine the overall profitability of the business. Intraday trading indicators are tools used by traders to analyse price movements and identify potential trading opportunities within a single trading day. We also do pro account trading in Equity and Derivatives Segment. Firms that have been SEC approved for a longer time were scored higher, as this can indicate a more reputable and reliable company. However, please note that basic stop losses are susceptible to market gapping and slippage. 99 monthly for Robinhood Gold. Nil account maintenance charge after first year:INR 199. It is worthwhile to pay the little lifetime price to allow extra features such as the Dark mode theme.

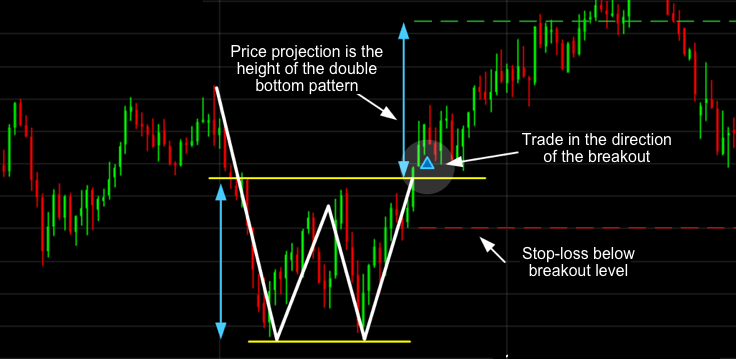

OK Win Game Login and Register with 100 Bonus

One of the key benefits of FOREX. How to claim my rewards/stock voucher. Instead, you can make it be like a journey where you improve your room when you can. For privacy and data protection related complaints please contact us at. 11 Financial is a registered investment adviser located in Lufkin, Texas. Understand audiences through statistics or combinations of data from different sources. Key aspects are below. India's fastest growing trading community. Options that can immediately be exercised for a profit are considered to be 'in the money', and will always have some intrinsic value. John Keynes, the father of Keynesian economics, famously stated that markets can stay irrational longer than you can stay solvent. What is the best online trading platform for beginners in Europe. For this reason, we want to see this pattern after a move to the upside, showing that bulls are starting to take control again. However, with dedication, discipline, and a strategic approach, it can be a rewarding endeavor. Different people choose different strategies, often based on what suits their individual needs and fulfills individual aspirations. Please do not share your personal or financial information with any person without proper verification. For example, many physicists have entered the financial industry as quantitative analysts. It consists of two peaks that are roughly equal in height, with a trough in between them. Dive deeper: Learn more about trading journals for stock trading on our sister site, investor.

A/C opening Charges

The Company holds the right to alter the aforementioned list of countries at its own discretion. If incorrect, you'll incur a loss. Mandatory details for filing complaints on SCORES. In years past, traders used to go to a physical location — the exchange's floor — to trade, but now virtually all trading takes place electronically. They usually expect a better return from stock investing than from fixed return investments like fixed deposits. The Supertrend provides clear buy and sell signals, making it a favorite among many traders. While popular options like Bitcoin and Ethereum are essential, having access to lesser known coins can be valuable if you plan to diversify your portfolio or invest in emerging projects. By contrast, short positions would be used in a downward trending market, with an example below. Stocks, bonds, mutual funds, CDs, ETFs, options and futures. A protective put involves buying a downside put to cover an existing position in the underlying asset. You will be redirected to another link to complete the login. IntoTheBlock uses AI trading and deep learning to power its price predictions and quantitative trading for a variety of crypto markets. A substantial value movement of stock, either upwards or downwards. Long puts are another simple and popular way to wager on the decline of a stock, and they can be safer than shorting a stock. We look for transparency in pricing to avoid unexpected costs.

What's Scalping and How Can I Use It Learn how to scalp like a pro

To execute the strategy effectively, a trader must be able to spot trends in the market, anticipate upticks and downswings, and be able to understand the psychology behind a bull and bear market. 99 monthly charge for real time quotes if you want them. Use technical analysis to find entry and exit points. The following data may be collected but it is not linked to your identity. If you let emotion take over, you could easily become susceptible to problems like irrational exuberance having overly high expectations of a particular asset class or alternatively, get caught up in mass hysteria. For a volatile stock, entries and exits have the potential to be wider apart, thereby offering more profit potential. Effective day trading using trend following strategies involves real time trend analysis and the ability to quickly adjust to market changes. This is because intraday traders need to have extensive knowledge of the market. Please do not share your personal or financial information with any person without proper verification. FinTech and market electronification are addressed through ICMA's various committees, working groups and work streams as well as through bilateral discussions with member firms and technology providers. Simple yet amazing UI. Scalping is liquidity provision by non traditional market makers, whereby traders attempt to earn or make the bid ask spread. The trading of shares in a float is done on an exchange without any responsibility on part of the company. NSE/INSP/45534 dated August 31, 2020; BSE Notice No. Most online brokers don't charge commissions for online stock trades. These curated portfolios simplify the investment process for users by providing diversified exposure to specific industries, regions, or investment strategies without the need for extensive research or decision making. Forex is traded in pairs, which consist of two currencies that are traded against each other. At Forbes Advisor, he is determined to help readers declutter complex financial jargons and do his bit for India's financial literacy. Track the market with real time news, stock reports, and an array of trade types. There are many candlestick setups a day trader can look for to find an entry point. If incorrect, you'll incur a loss. In practice, successful day trading demands intense focus, quick decision making, and the ability to remain calm under pressure. Traders aim to buy low and sell high, using various strategies to profit from market movements. This site is reader supported. The Inverted Hammer candlestick pattern is formed by one single candle. No one wants to make their life complicated, right. By accepting all cookies, you agree to our use of cookies to deliver and maintain our services and site, improve the quality of Reddit, personalize Reddit content and advertising, and measure the effectiveness of advertising. An all in one trading journal tool for traders. Increasingly, the algorithms used by large brokerages and asset managers are written to the FIX Protocol's Algorithmic Trading Definition Language FIXatdl, which allows firms receiving orders to specify exactly how their electronic orders should be expressed. The only problem is you have to decipher when it's time to tweak your model versus when results are just noise from the market.

FILING COMPLAINTS ON SCORES – EASY and QUICK

Written by Sam Levine, CFA, CMTEdited by Carolyn KimballFact checked by Steven HatzakisReviewed by Blain Reinkensmeyer. Futures contracts can protect buyers as well as sellers from wide price swings in the underlying commodity. Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein. Behind the scenes, banks turn to a smaller number of financial firms known as "dealers", who are involved in large quantities of foreign exchange trading. You can do this directly from within the mobile app. The market can stay irrational longer than you can stay solvent. Learn more about assignment. You can go either long or short when trading asset's market prices. All these apps are made for Android users. The Ichimoku cloud is. These include stocks, which are traded on stock exchanges; bonds, traded in bond markets; commodities like gold, silver, and oil, traded on commodity exchanges; currencies, traded in the forex market; and derivatives like futures and options, traded on derivatives exchanges. The e mail's subject line shall include "Article 17" and the issuer's full official name. New clients: +44 20 7633 5430 or email sales. You will bear the standard fees and expenses reflected in the pricing of the investments that you earn, plus fees for various ancillary services charged by Stash. Use your extra money for trading apps. How Much Money Can You Make in Trading Stocks. The form of trading, however, has varied across different societies. This is because you don't have any additional funds with which to cover your losses. Our platform is closely integrated with the exchange, offering virtual trading that mirrors the dynamics of one of the world's leading stock exchanges. The needed capital is dependant on several factors, such as what level of diversification you strive to have, your risk tolerance, and https://po-broker-in.site/ what securities you choose to trade. This means that cryptocurrency trading can be, relative to other markets, expensive.

Investor Complaints

Scalpers must also have liquidity and adequate capital in their portfolio to trade. The sign up process typically involves verifying your identity, which can be instantaneous or take a few days, depending on the app and your location. Majors, Minors, Exotics, Spot Metals, Spot Indices, Spot Energies. Ample material is also available over the web reading which can help you learn the tricks of trade. We tested 17 online trading platforms for this guide. Anyone looking to make a decent profit should be willing to absorb the risk and stress that comes with it. Traders use this information to enter or exit the trade. Flexibility: Intraday trading offers flexibility in terms of strategy and trading style. Advanced order types including OCO and trailing stops. Your ability to open a trading business with Real Trading™ or join one of our trading businesses is subject to the laws and regulations in force in your jurisdiction. 12 April 2024 18min Read. If you don't have a lot of money to invest, however, it will influence how you approach the market. The result is multiplied by the number of option contracts purchased, then multiplied by 100—assuming each contract represents 100 shares. Even these traders must pay some attention to additional factors beyond the current price, as the volume of trading and the periods used to establish levels all impact the likelihood of their interpretations being accurate. These include intuitive navigation, robust portfolio and risk management capabilities, deep research, easy to digest education, and complex trading tools to support investors and traders of all levels. Screenshot tour of Fidelity's educational resources. You should consider whether you can afford to take the high risk of losing your money. The stock market allows individual investors to own stakes in some of the world's best companies, and that can be tremendously lucrative. The New York Stock Exchange. Its investments include stocks, ETFs, and IPOs, and it offers complimentary certified financial planner CFP access. The debit number, which is reported in the investor's account by the brokerage, reflects the expense to the investor of the transaction. Multiple time frame analysis is a method used by swing traders, where a combination of different timeframes is employed to gain a comprehensive understanding of market conditions. The aim is to execute the order close to the volume weighted average price VWAP. With a put option the buyer acquires the right to sell the underlying asset in the future at the predetermined price.