Content

In all scenarios, it becomes a fine balancing act for the business operators to adjust pricing, volume, and cost controls. As typical profit margins vary by industry sector, care should be taken when comparing the figures for different businesses. In everyday use, however, it usually refers to net profit margin, a company’s bottom line after all other expenses, including taxes and one-off oddities, have been taken out of revenue. The profit margin calculator is a free tool Shopify offers to businesses.

- Gross margin is a kind of profit margin, specifically a form of profit divided by net revenue, e.

- High-end luxury goods have low sales, but high profits per unit make up for high-profit margins.

- Direct expenses refer to the cost of creating or developing a product or service.

- Shopify has dropshipping apps that can help you start selling to customers within minutes, without the hassle of inventory, packing and shipping.

- If so, we offer a number of helpful Excel spreadsheets to help businesses stay organized & on top of their finances & financial projections.

All the terms are a bit blurry and everyone uses them in slightly different contexts. For example, costs may or may not include expenses other than COGS - usually, they don't. In this calculator, we are using these terms interchangeably and forgive us if they're https://online-accounting.net/ not in line with some definitions. To us, what's more important is what these terms mean to most people, and for this simple calculation the differences don't really matter. Luckily, it's likely that you already know what you need and how to treat this data.

Retail Margin Formula

If the market moves against a trader, resulting in losses such that there is an insufficient amount of margin, an automatic margin call will apply. This usually happens because there is no more money in the account to withstand the loss in value of equities, and the broker starts to become responsible for losses. Cost of goods sold includes the labor, materials, and manufacturing overhead costs to produce her product (in other words, “direct costs”). The Gross Profit Margin shows the income a company has left over after paying off all direct expenses related to manufacturing a product or providing a service. It indicates that over the quarter, the business managed to generate profits worth 20 cents for every dollar worth of sales.

An accountant, consultant, or business mentor can help calculate costs. Estimates to start a food business range widely, depending on the product. Consider working with an accountant or consultant to best understand the cost of production for each unit and pricing strategies. Be sure to set up a separate business bank account to help keep accurate financial records. Markup is the amount by which the cost of a product is increased in order to derive the selling price.

How to calculate profit margin

The math for margin percentage is the difference between the price and the cost divided by the selling price. Pricing margin percentage allows you to set uniform profit margins on products with different costs or to set margins by the type of product. Using percentages also allows you to calculate an average profit margin for all of the products you sell. At a certain production level, the sum of your fixed and variable costs equals your total cost. To do that, take your total costs and divide them by the number of units produced.

Although both measure the performance of a business, margin and profit are not the same. All margin metrics are given in percent values, and therefore deal with relative change, good for comparing things that are operating on a completely different scale. Profit is explicitly in currency terms, and so provides a more absolute context - good for comparing day to day operations. Having difficult clients can cost you a lot of time and revenue, which puts strain on your business. Do they order a lot or frequently enough to justify keeping them?

What Business Has the Highest Profit Margin?

Download our free guide, Price to Sell … and Profit, to start setting prices that are based on data (and not just a whim!). In any case, your Profit Margin can never exceed 100 percent, which only happens if you’re able to sell something that cost you nothing. In the agriculture industry, particularly the European Union, How to Calculate a 50% Margin Standard Gross Margin is used to assess farm profitability. To edit the Excel calculator, you can insert or delete rows as necessary, based on the information you have. For example, to add more expense line items such as “Salaries and Wages”, simply insert a row for each one and add the numbers as appropriate.

- You can set fixed prices for your products, but a fixed markup will always keep your price a consistent percentage above your cost.

- These methods produce different percentages, yet both percentages are valid descriptions of the profit.

- One way to gauge consumer interest is to test your product at farmers markets.

- I wouldn’t necessarily try converting one thing into the other.

- Here are several strategies you can take to increase your company’s profit margin.

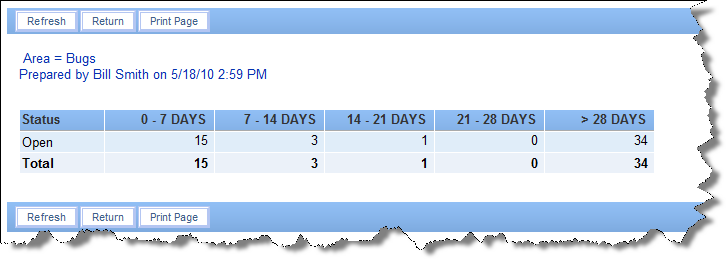

Below is a screenshot of CFI’s profit margin Excel calculator. As you can see from the image, the Excel file allows you to input various assumptions over a five year period. All cells with blue font and light grey shading can be used to enter your own numbers. All cells with black font are formulas and don’t need to be edited. Wholesale costYour total wholesale cost of the product that you are going to resell. In retail, margins can be quite low sometimes as there is high competition, however, the average retail margins usually range between 50-55%.