Content

It can be defined as the total number of dollars that a company would have left if it liquidated all of its assets and paid off all of its liabilities. Johnson INC. purchased a machine for $ and paid $ in cash; the rest was allowed to be paid later. The transaction results in an inflow of machines, an outflow of cash, and the creation of liability for the balance amount to be paid. The first step to do so is to learn how to identify and analyse business events or transactions.

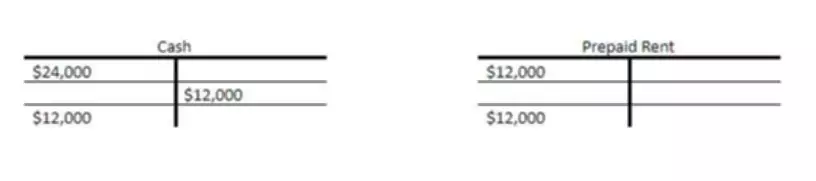

In our examples below, we show how a given transaction affects the accounting equation. We also show how the same transaction affects specific accounts by providing the journal entry that is used to record the transaction in the company's general ledger. Bench gives you a dedicated bookkeeper supported by a team of knowledgeable small business experts. We’re here to take the guesswork out of running your own business—for good. Your bookkeeping team imports bank statements, categorizes transactions, and prepares financial statements every month. Assets represent the valuable resources controlled by the company, while liabilities represent its obligations.

Statement of financial position definition

Another component of shareholders’ equity is the business’s earnings. These retained earnings are what the business holds onto at the end of a period to reinvest in the business, after any distributions to ownership occur. Stated more technically, retained earnings are a business’s cumulative earnings since the creation of the business minus any dividends that it has declared or paid since its creation. One tricky point to remember is that retained earnings are not classified as assets.

- For management reporting but not be required for statutory reporting.

- Cash includes paper currency as well as coins, cheques, bank accounts, PayPal accounts.

- All of the basic accounting equations discussed throughout this post stress the importance of double-entry bookkeeping.

- However, when Maxidrive sells its disk drives to Dell and Apple, it receives a promise of future payment called an account receivable, which later is collected in cash.

- For example, Maxidrive had to sell more than $37 million worth of disk drives to make just over $3 million.

- Here you want to see a trend where the operating profit margin is increasing every quarter and year.

Double-entry accounting uses the accounting equation to show the relationship between assets, liabilities, and equity. When you use the accounting equation, you can see if you use business funds for your assets or finance them through debt. The accounting equation is also called the balance sheet equation. Stockholders' equity indicates the amount of financing provided by owners of the business and earnings. The investment of cash and other assets in the business by the owners is called contributed capital.

Income And Retained Earnings

Accounts payable recognises that the business owes money and has not paid. Remember, when a customer purchases something “on account” it means the customer has asked to be billed and will pay at a later date. Which of the following statements below lists the rules of entering transactions into the

accounting equation? The accounting equation must always remain in balance so that assets

always equal the sum of liabilities and equity.

- As the fintech industry continues to expand, memorizing accounting equations will become obsolete.

- If you have high sales revenue but still have a low profit margin, it might be time to take a look at the figures making up your net income.

- The owner’s equity is the business’s amount to its owner, i.e., capital or reserves and surplus.

- The balance sheet or the statement of financial position is the financial statement that represents the basic accounting...

- You only enter the transactions once rather than show the impact of the transactions on two or more accounts.

- Maxidrive's net income measures its success in selling disk drives for more than the cost to generate those sales.

- Put another way, it is the amount that would remain if the company liquidated all of its assets and paid off all of its debts.

His initial investment was $4,

cash in exchange for common stock. Demonstrate how to record this transaction in the

accounting equation. This article gives a definition of accounting equation and explains double-entry bookkeeping.

Financial Statements:

The accounting equation helps understand the relationship between assets, liabilities, and owner’s equity. Assets are resources owned by an organization that helps generate future economic benefits. In contrast, liabilities are financial obligations that will result in an outflow of economic resources, i.e., cash outflow or any other asset. The owner’s equity is the business’s amount to its owner, i.e., capital or reserves and surplus. It can also be described as the difference between assets and liabilities. The accounting equation forms the basis of double-entry accounting, where every transaction will affect both sides of the equation.

Equipment examples include desks, chairs, and computers; anything that has a long-term value to the business that is used in the office. Equipment is considered a long-term asset, meaning you can use it for more https://www.bookstime.com/articles/the-accounting-equation-may-be-expressed-as than one accounting period (a year for example). Equipment will lose value over time, in a process called depreciation. You will learn more about this topic in Chapter 3, and Accounting, Business and Society.

Introduction to the Accounting Equation

For instance, if a business takes a loan from a bank, the borrowed money will be reflected in its balance sheet as both an increase in the company’s assets and an increase in its loan liability. Knowing how to calculate retained earnings allows owners to perform a more in-depth financial analysis. The statement of retained earnings allows owners to analyze net income https://www.bookstime.com/ after accounting for dividend payouts. Owners should calculate the statement of retained earnings at the end of each accounting period, even if the amount of dividends issued was zero. The statement of financial position is another term for the balance sheet. The statement lists the assets, liabilities, and equity of an organization as of the report date.

It tells us how much money any company has in the Bank and how likely it is for the business to meet all its financial obligations. It also helps us evaluate the amount of profit or loss a business has incurred since its inception. The accounting equation helps determine if the company has sufficient funds to purchase an asset, if debts should be paid off with the existing assets, or by creating more liabilities. The income statement is the financial statement that reports a company's revenues and expenses and the resulting net income.

Owner’s Equity

Insurance, for example, is usually purchased for more than one month at a time (six months typically). The business does not use all six months of the insurance at once, it uses it one month at a time. As each month passes, the business will adjust its records to reflect the cost of one month of insurance usage.

- The balance sheet reports a company's assets, liabilities, and owner's (or stockholders') equity at a specific point in time.

- He is the sole author of all the materials on AccountingCoach.com.

- In other words, it’s the amount of money the owner has invested in his or her own company.

- Which of the following statements is correct regarding revenues?

- These retained earnings are what the business holds onto at the end of a period to reinvest in the business, after any distributions to ownership occur.

- For instance, if a business takes a loan from a bank, the borrowed money will be reflected in its balance sheet as both an increase in the company’s assets and an increase in its loan liability.

There are two different approaches to the double entry system of bookkeeping. They are the Traditional Approach and the Accounting Equation Approach. Locate the company’s total assets on the balance sheet for the period.